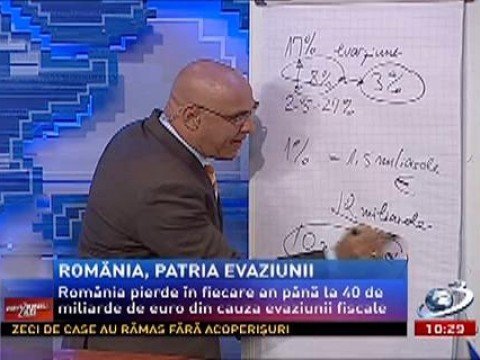

The mafia in the fruit and vegetable sectors, tobacco and oil products incurs million Euros losses for the state budget. Romania loses every year up to 40 billion Euros by tax evasion, the European reports estimate. The percentage of the tax evasion in Romani has exceeded the European average by 17%.

The latest report of the Court of Accounts conducted in 2007-2010 on dues and tax collection for the public budget shows that the underground economy in Romania reached 30-40 percent of the GDP.

In the fruits and vegetables trade, tax evasion is estimated at a minimum of one billion Euros. The most used method to defraud the state is illegal VAT refunds. Importers circulate money and goods through mock companies, so they never pay taxes. However, fraudsters artificially inflate prices for consumers even by 3 to 4 times. The government has already announced that it will step up checks in this sector.

Alcohol is another source of black money. The data from the Garant employers show that evasion in this sector amounts to approximately 750 million per year, mainly from sales excluding VAT and excise duty on alcohol produced in small domestic or clandestine factories.

As for cigarettes, the tax evasion this year amounts to half a billion Euros, producers estimate. At the top of the list are the products imported from Ukraine, Moldova and Serbia.

In the milling and baking, the black market exceeded 70% at the end of 2012, exceeding 230 million Euros. To reduce tax evasion which has reached alarming levels, the IRS will be reorganized.

Romanian authorities have so far applied several measures to fight evasion. From special taxes for transactions made towards tax havens up to taxing individuals with high fortunes.

Another step is the Ordinance that eliminates the shielded advertising commissions. The draft legislative initiative is currently in the Senate. The companies set to lose the benefits they are not paying taxes for, are pressuring for this bill to be amended, so that they would not lose their charges and the possibility to impose prices on end beneficiaries and TV stations.